Emerging markets

Emerging markets

In simple terms, it’s where you want to be investing if you want to have good growth potential.

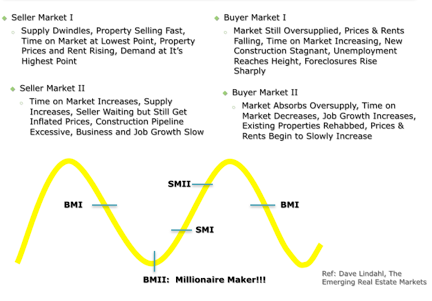

With Commercial Real Estate, the market moves in cycles, much like a sine wave or a roller coster (see above). Each cycle has four phases, Buyer’s Market I, Buyers’s Market II, Seller’s Market I, Seller’s Market II. These cycles can last 8 - 12 years or longer. The best part is, they always follow the same order!

If you read the definitions above the graph, you will see some of the characteristics behind each phase of a Market Cycle. Noting some of the key traits of the market which is getting ready for a downturn are, Business and Job Growth starts to Slow or Decline. Units that were being built while the market was hot, are now causing an increase in supply and Time on Market begins to Increase. If you wait too long, trying to hold out for top dollar, you will ending up riding the roller coaster down and that’s not where you want to be.

Once the market has bottomed out in BMII, you have an incredible opportunity to acquire inventory at extremely low prices. For this to happen, you need a few key indicators. Jobs start to come in, rents are starting to increase for the first time in a long time and there will be less inventory on the market. Buying at this time is WHERE YOU REALLY MAKE MONEY! Typically for the next 3 - 5 years you can ride the wave upward.

The News and Investing.

The News seems to lag behind Market Cycles. You’ll hear on the news that it’s a great time to buy Real Estate (remember when the bottom fell out), yet savoy investors knew that it was nearing its peak and should sell. On the other hand, while in BMII, you’ll hear them say what a bad time it is to buy. This tends to work in our favor, as it helps to keep prices low for a time. You’ll see only local investors as well as investors that know the Market Cycles investing. The mainstream will come in after the fact and start driving prices skyward.

Different parts of the country are in different phases. The really GREAT thing is that there are Emerging Markets RIGHT NOW in parts of this country. We don’t all follow the same Cycle at the same time. You just need to know where they are!

We have just touched on what an Emerging Market is here to give you a basic idea. This is so much more to it than just this.

We will have a link to a form for you to fill out soon if you’d like more information about emerging markets or investing with us. In the mean time, please email us to request the form. - Thanks

This is just a brief introduction to Emerging Markets.

We will have a link to a form for you to fill out soon if you’d like more information about emerging markets or investing with us. In the mean time, please email us to request the form. - Thanks

What is an Emerging Market?

© 2012 K & A Investments LLC